THE HUSTLERS BUCKS

Economy | Finance | Stock market updates💹 Business | Startup insights📇 Research on companies | sectors🔎 💰 Lifestyle Motivation , Make Money Online , Affiliate Marketing , CPA Marketing

Tuesday, 1 August 2023

Thursday, 1 June 2023

how to make money online from home

Unleashing the Power of the Internet: How to Make Money Online from Home

In today's digital age, making money online from the comfort of your own home has become a viable and increasingly popular option. The internet offers a multitude of opportunities for individuals to earn income and even build thriving businesses. In this article, we will explore five effective methods to make money online, providing you with the tools and insights to embark on your online money-making journey.

Freelancing - Freelancing is a versatile and accessible way to make money online. With a wide range of skills in demand, platforms like Upwork, Freelancer, and Fiverr connect freelancers with clients from around the world. Whether you possess graphic design, writing, coding, or marketing expertise, there is a high likelihood of finding freelance gigs that align with your abilities. By building a strong portfolio and cultivating positive client relationships, you can establish a solid reputation and secure a steady stream of work.

Online Surveys and Microtasks -If you are looking for a simple and relatively quick way to earn some extra cash, participating in online surveys and microtasks can be an ideal choice. Numerous websites, such as Swagbucks, Survey Junkie, and Amazon Mechanical Turk, offer paid surveys, small tasks, and data entry jobs. Although the earnings may be modest, completing multiple surveys or microtasks consistently can accumulate into a meaningful income over time.

E-commerce and Dropshipping - The rise of e-commerce has created unprecedented opportunities for entrepreneurs to start their online businesses. With platforms like Shopify and WooCommerce, setting up an online store has become easier than ever. Moreover, dropshipping allows you to sell products without the need for inventory management or shipping. By selecting a niche, sourcing products from suppliers, and marketing your store effectively, you can generate significant profits through e-commerce.

Affiliate Marketing - Affiliate marketing is a popular method of earning passive income by promoting other people's products or services and receiving a commission for each sale made through your referral. Joining affiliate programs such as Amazon Associates, ClickBank, or CJ Affiliate enables you to access a wide range of products to promote. To succeed in affiliate marketing, it is crucial to identify a target audience, create engaging content, and utilize various marketing channels such as websites, social media, and email newsletters.

Content Creation and Monetization -With the advent of platforms like YouTube, Twitch, and TikTok, content creators have transformed their hobbies into lucrative online careers. By producing high-quality videos, streaming live gameplay, or creating engaging short-form content, you can attract a dedicated audience. Monetization options, such as ad revenue, brand partnerships, sponsorships, and merchandise sales, provide avenues for content creators to generate substantial income. Consistency, authenticity, and understanding your audience's preferences are key to building a successful content creation career.

The internet has revolutionized the way we work and opened up countless opportunities for individuals to make money online from the comfort of their homes. Whether you choose freelancing, online surveys, e-commerce, affiliate marketing, or content creation, success requires dedication, perseverance, and a willingness to adapt to the ever-evolving digital landscape. Embrace the power of the internet, unleash your creativity, and embark on a rewarding online money-making journey.

Monday, 31 October 2022

how to become financially independent

How to Reach Financial Freedom: 12 Steps0 to Get You There

- Financial independence means having enough income or wealth to pay for your own expenses without additional assistance.

- Steps to becoming financially independent include setting goals and a budget, creating a safety net, diversifying your income and more.

- Additional resources, such as speaking with a financial advisor and looking into financial education, can help you make informed decisions.

For many people, reaching a point of financial independence is a major milestone that can be hugely exciting and open many possibilities. Financial independence is a financial situation in which you have enough money, either via income or accumulated wealth, to pay your expenses for the rest of your life without dependence on others.

Financial freedom inevitably looks different for everyone, and the steps for achieving financial independence may change as a result.

Still, even though steps for how to become financially independent may differ among financial situations, there are a number of common boxes that people should check to become financially independent. Understanding these steps, their importance and how they can be achieved can set you on the road to know how to be financially independent.

1. Identify clear, achievable goals

Financial independence may be easier to accomplish for an individual who has a clear idea of what they’d like to achieve and when they’d like to achieve it. A savvy way to approach establishing your financial goals is through the SMART (specific, measurable, achievable, realistic and time-bound) framework.

Goals are different for each person and can vary in scope considerably. These goals may include anything from paying down a set amount of debt per month to purchasing a new home. Regardless of your specific situation, it’s helpful to set both short-term (setting aside a solid rainy day fund, paying for a minor home improvement) and long-term financial goals (early retirement, buying a house).

2. Set up a budget

A thorough budget will likely make it simpler to ensure your money is being used wisely and that you are on the path to reaching your goals.

Knowing how to make a budget is the first step. A strong monthly budget should include:

- Monthly income

- Household maintenance

- Clothing and personal care

- Groceries and prescriptions

- Rent or mortgage payments

- Entertainment and travel expenses

- Monthly subscriptions, memberships and dues

- Recurring expenses (bills, credit card debt, bank fees, etc.)

You can add additional categories, depending on your specific financial situation. For instance, you may need to add a pet care category if you have pets or may not need to include a monthly subscriptions, memberships and dues category if you do not have these costs.

No matter your situation, your budget should be comprehensive and identify exactly where your money is going, while making it simpler to identify areas for financial improvement.

3. Create a safety net

An urgent step to take is establishing a solid financial safety net as quickly as possible. Having a cushion is a major factor in becoming financially independent. Create an emergency fund alongside your typical savings account and funnel money into that fund whenever you can. You should save enough to cover at least three to six months’ worth of living expenses, so you don’t have to depend on any outside help in the event of unforeseen circumstances.

4. Save automatically

Using automated features can help you save money.

For instance, direct deposit can direct money to several different accounts at once, enabling you to grow your savings while sending money into your checking account, too. You should consider using an income percentage, rather than a hard number, when setting up direct deposit distribution. This allows contributions to increase automatically with pay increases.

Another approach to consider is automated transfers. Some financial institutions also offer the ability to schedule recurring transfers from checking to savings accounts to make sure you are always contributing to your nest egg.

5. Establish or build your credit

Good credit can make achieving certain long-term goals easier. A solid credit score can help you:

- Get a leg up as a renter in competitive markets

- Secure lower interest rates on financing, such as car loans or mortgages

- Be approved for higher credit limits and loan amounts (including business loans, as business lenders use both business credit scores and personal credit scores to vet borrowers)

These perks can positively affect reaching independence-related goals, such as moving into a more appealing apartment, growing a cushion for retirement or securing a loan to start your own business.

There are several ways to build credit, but the easiest first steps include using a secured or beginner-friendly credit card or being added as an authorized user on a responsible cardholder’s account. As you establish your credit, you will have more options to keep building it.

6. Diversify your income

Another way to ensure long-term financial stability is to have several income streams. Consider ways you can make extra cash, in addition to whatever your primary job provides. Extra streams of income can take many forms, from freelancing or establishing a “side hustle” (such as graphic design or writing) to walking dogs. Passive income streams from investments also can be a good way to supplement your primary source of income.

7. Get professional financial advice

Professional guidance can help you map your plan for how to be financially independent. A financial advisor can be a good resource to help you understand your money and gain important financial education concerning saving, retirement planning and more.

8. Start Investing Now

Bad stock markets—known as bear markets—can make people question the wisdom of investing, but historically there has been no better way to grow your money. The magic of compound interest alone will grow your money exponentially, but you do need a lot of time to achieve meaningful growth.

However, remember that—for everyone except professional investors—it would be a mistake to attempt the kind of stock picking made famous by billionaires like Warren Buffett. Instead, open an online brokerage account that makes it easy for you to learn how to invest, create a manageable portfolio, and make weekly or monthly contributions to it automatically. We’ve ranked the best online brokers for beginners to help you get started.

9. Negotiate for Goods and Services

Many Americans are hesitant to negotiate for goods and services, because they're afraid that it makes them seem cheap. Conquer this fear and you could save thousands each year. Small businesses, in particular, tend to be open to negotiation, so buying in bulk or positioning yourself as a repeat customer can open the door to good discounts.

10. Stay Educated on Financial Issues

Review relevant changes in tax law to ensure that all adjustments and deductions are maximized each year. Keep up with financial news and developments in the stock market and do not hesitate to adjust your investment portfolio accordingly. Knowledge is also the best defense against fraudsters who prey on unsophisticated investors to turn a quick buck.

11. Maintain Your Property

Taking good care of property makes everything from cars and lawnmowers to shoes and clothes last longer. The cost of maintenance is a fraction of the cost of replacement, so it’s an investment not to be missed.

12. Invest in your health.

Did you know that taking care of your physical health can have a positive impact on your financial health? Unfortunately, the opposite is also true—poor health maintenance can negatively affect your financial goals.3

If your company has limited sick days, for example, you may lose income if you use up paid time off and still need to miss work. Also, certain health problems can make your insurance premiums skyrocket. And poor health may force you to retire before you're ready, leaving you with a lower monthly income than you were expecting.3

On the positive side, by making regular visits to doctors, dentists, and other healthcare providers—and following advice about any issues that arise—you can make an essential investment in your physical and financial health. Many medical issues can be prevented or managed with basic lifestyle changes, including regular exercise and a healthy diet.3

Thursday, 27 October 2022

How to Grow Your Youtube Channel

10 Ways to Grow Your YouTube Channel

Did you know that YouTube currently has 2 billion active users a month and is projected to grow to almost 3 billion active users by 2025?

It's one of the fastest-growing and most popular social networks today. Plus, it helps people grow their businesses.

In fact, the number of channels earning six figures per year on YouTube grew more than 40% y/y, the number of channels earning five figures per year on YouTube grew more than 50% y/y, and the number of channels with more than one million subscribers grew by more than 65% y/y.

Now, all that being said, you might be wondering, "How do I grow my YouTube channel so I can drive more traffic to my website and revenue to my business?"

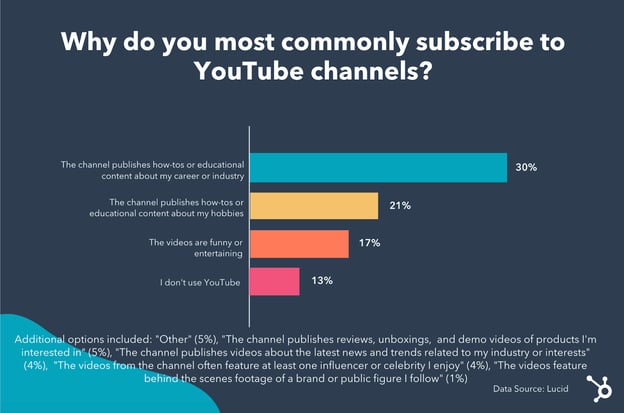

To help marketers and business owners answer this question, we asked 300 consumers why they most commonly subscribe to YouTube channels.

After looking into the data, we'll dive into our findings to help you better design effective strategies toward connecting with your audience on YouTube.

Let's get started.

Why Do Consumers Subscribe to YouTube Channels

30% of respondents said they most commonly subscribe to YouTube channels because the channel publishes how-tos or educational content about their career or industry.

21% of respondents subscribe to channels because the channel publishes how-tos or educational content about their hobbies.

And 17% of respondents said they subscribe to YouTube channels because they post funny or entertaining videos.

To review the rest of the answers, see the graphic below:

atOptions = {

'key' : 'f052957fdba17ab57cee3a49758c1acf',

'format' : 'iframe',

'height' : 50,

'width' : 320,

'params' : {}

};

document.write('

atOptions = {

'key' : 'f052957fdba17ab57cee3a49758c1acf',

'format' : 'iframe',

'height' : 50,

'width' : 320,

'params' : {}

};

document.write('

Data Source

So, now that we know why people are subscribing to YouTube channels, let's dive into how you can use this information to grow your channel.

Best Ways to Grow Your YouTube Channel

- Create educational content about your audience's career.

- Publish educational content about your audience's hobbies.

- Create interesting, dynamic, interactive videos.

- Know your audience.

- Reformat well-performing content.

- Optimize your content.

- Find untapped keywords.

- Optimize for watch time.

- USE TUBE BUDDY

Top Ways TubeBuddy Can Help a Small YouTube Channel Grow Right NOW

CLICK HERE TO KNOW MORE

1. Create educational content about your audience's career.

As the survey said, the main reason that consumers subscribe to YouTube channels is that they post educational content about their careers.

Think about it. The reason people go online is to find an answer to a question they want (or to be entertained, but we'll get to that later).

So, a great way to grow your channel is to publish the topics that your audience wants to see. For example, at HubSpot, we publish educational videos on YouTube about marketing, sales, service, and general business content.

All these videos help our audience learn and develop in their careers. Of course, we'd like people to use our software to do that, but you'll get value out of the video whether you're a HubSpot customer or not.

2. Publish educational content about your audience's hobbies.

Now, let's say that your business isn't exactly geared toward your audience's career. What do you post then?

Well, according to the survey, you can post content about your audience's hobbies. Let's say that you're a landscaping company. On your website, you could post content about gardening and really target people who garden as a hobby. Then, there's a clear conversion path to using your services.

However, while you'd like people to convert and become customers, your videos should give value away for free and educate your audience. The more they see you as an expert in the industry and the go-to people, the more likely they will be to convert later on.

3. Create interesting, dynamic, interactive videos.

The third most popular reason that people subscribed to YouTube channels was because the videos were entertaining or funny.

If you're a creator who wants to post fun, interesting, entertaining videos, you can grow your YouTube channel by thinking about an audience who enjoys watching certain entertainment.

For example, let's say you have a creator channel and you mostly post lifestyle videos. To make those interesting and entertaining, you need to know what your audience likes and dislikes. That brings me to the next strategy.

4. Know your audience.

The best way to grow your YouTube channel is to know what your audience likes and wants to see. Do they want to see educational content about their career? Or perhaps they're just looking to unwind and watch people clean houses because it's satisfying and entertaining.

Regardless, think about the reasons from our survey that will resonate with your audience the most, and then lean into those ideas.

5. Reformat well-performing content.

A great way to focus on growing your YouTube channel is to reformat content that has already performed well for you. That might mean turning your most popular blog post into a video.

You'll need to rework the information and film a video about that topic, but you're already starting out ahead. You know that your audience likes that content and wants to see it.

Think about your best-performing content from any content marketing channel and reformat it to video.

6. Optimize your content.

Now, of course, we can't get through a content marketing discussion without talking about SEO. But, how do you optimize your YouTube videos?

To do this, you'll want to include your target keywords in your titles and descriptions. Then, make sure you mention those keywords in your video.

The YouTube algorithm will use those context clues to understand what your video is about. And then if you get engagement, it will rank higher in the search results.

You might be wondering, "How do I grow my YouTube channel fast? And how long will it take to grow my YouTube channel?"

According to data, it takes an average of 22 months for a channel to reach 1,000 subscribers. Yet, if you don't optimize your videos and have less than 1,000 subscribers, then you'll get less than 10% of the total views on YouTube. That's why it's so important to grow your channel and subscriber list.

7. Find untapped keywords.

Another strategy you might use to grow your YouTube channel quickly is to find untapped keywords. You can look at related searches of a topic on YouTube or Google, and then look at those related searches in a keyword tool.

Which keywords get a lot of searches, but have low competition? Those are the keywords you'll want to target.

8. Optimize for watch time.

Just like with any search engine, YouTube wants people on YouTube. So one of the main factors the site considers for ranking is watch time.

Whenever you post videos, it's important to analyze how long people are watching your videos. According to research from Backlinko, longer videos tend to outrank short videos. And it makes sense. The longer your videos, the longer your watch time can be.

But, how can you make sure people get past the first few seconds of your video? A great way to do this is to cut extraneous content from your intro. In the first few seconds, a viewer should know what they'll learn and what they'll get out of watching your video.

If you've properly targeted your audience with the right content, that means they'll end up watching your long videos because you've captured their attention.

Growing your audience on YouTube is a great way to attract audiences to your company. And having more than 1,000 subscribers is imperative for ranking higher in search results. So, that means you need to post content that your audience wants to see and is optimized so it shows up in the search results.

Get 500$ PayPal Gift Card

What is a PayPal Gift Card A PayPal gift card is a prepaid card that allows purchases up to the card’s value on any website...

-

25 Highest Paying Affiliate Program to Join in 2023–2024 Consistently, a great many distributers benefit from a repetitive money inflow...

-

Pinterest Marketing – A Powerful Guide for Marketers in 2023 If you don’t have a solid plan in place for using Pinterest as part of your b...

-

How to Reach Financial Freedom: 12 Steps0 to Get You There Financial independence means having enough income or wealth to pay for your own...